$1,250 or $4.1 million?

On Feb. 14, Delta employees like us received a $1,250 “profit sharing” payment for 2021…even though Delta lost money in 2021.

In his letter announcing the payment, Ed Bastian told us “our people drove this success, which is why we were happy to announce this morning a special profit-sharing payment for all eligible employees."

We'll take the money. But is that really why we received this payment? Or did Ed and the rest of the C-suite have another reason? Or maybe $11.4 million reasons?

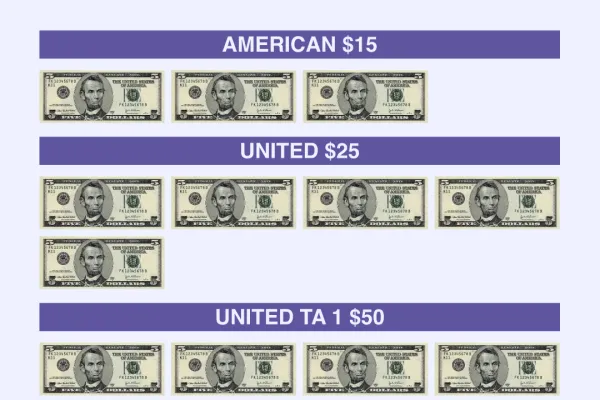

Delta’s profit-sharing program for employees is directly tied to compensation for its top executives. Specifically, executives receive stock options that only vest if the airline makes a profit sharing payment to employees.[1] Since there were no profits to share in 2021, executives were poised to miss out on more than $11.4 million in options—Ed Bastian alone would have forfeited more than $4.1 million.[2]

But because of the "Special Profit Sharing" based on a different formula we received this year, management was able to keep more than $11 million in total stock options.[3] Bastian alone took home $950,000 salary, $4.1 million in stock, another $4.1 million in stock options, $3 million in incentive pay and $121,630 in other compensation.

Right now, Delta is using a lot of carrots to try to slow the momentum we're building in our organizing— finally delivering raises and boarding pay, for example. But the bonus payments may have been a way for the highest earning executives to have their cake and eat it, too.

Not only could executives use a “profit sharing” check as a way to make the company look generous to workers, they made sure to preserve their own multi-million dollar stock options.

There’s no question that our union drive is making management give us more in an attempt to buy away our rights. But at the same time, it looks like they’re back to using every trick in the book to reward themselves. Come September, Wall Street will be knocking on the door, demanding its share when the prohibition of stock buybacks ends.

The only way we can protect what we love, have a voice in our future, and ensure we have a fair share of the value we create is by locking it in with a union contract. Sign your card today, and join our campaign for voice and a union contract at Delta.

1. Delta 2021 Proxy Statement, May 7 2021, p.35